unemployment tax credit refund 2021

Unemployment compensation is not considered earned income for the Earned Income Tax Credit EITC childcare credit and the Additional Child Tax Credit calculations and. The IRS plans to issue another tranche of refunds before the end of the year.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. Like all tax refunds it. The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to.

You did not get the unemployment exclusion on the 2020 tax return that you filed. And for taxpayers expecting a refund for 2021 unemployment compensation up to 10200 of this compensation was excluded from taxes for qualifying single taxpayers and. Unemployment Income Rules for Tax Year 2021.

July 30 2021 837 AM flamingo1953 The IRS is sending out the refunds for the unemployment exclusion over the course of the summer. Do you have to pay unemployment back. Data is seasonally adjusted and through Dec 25 2021.

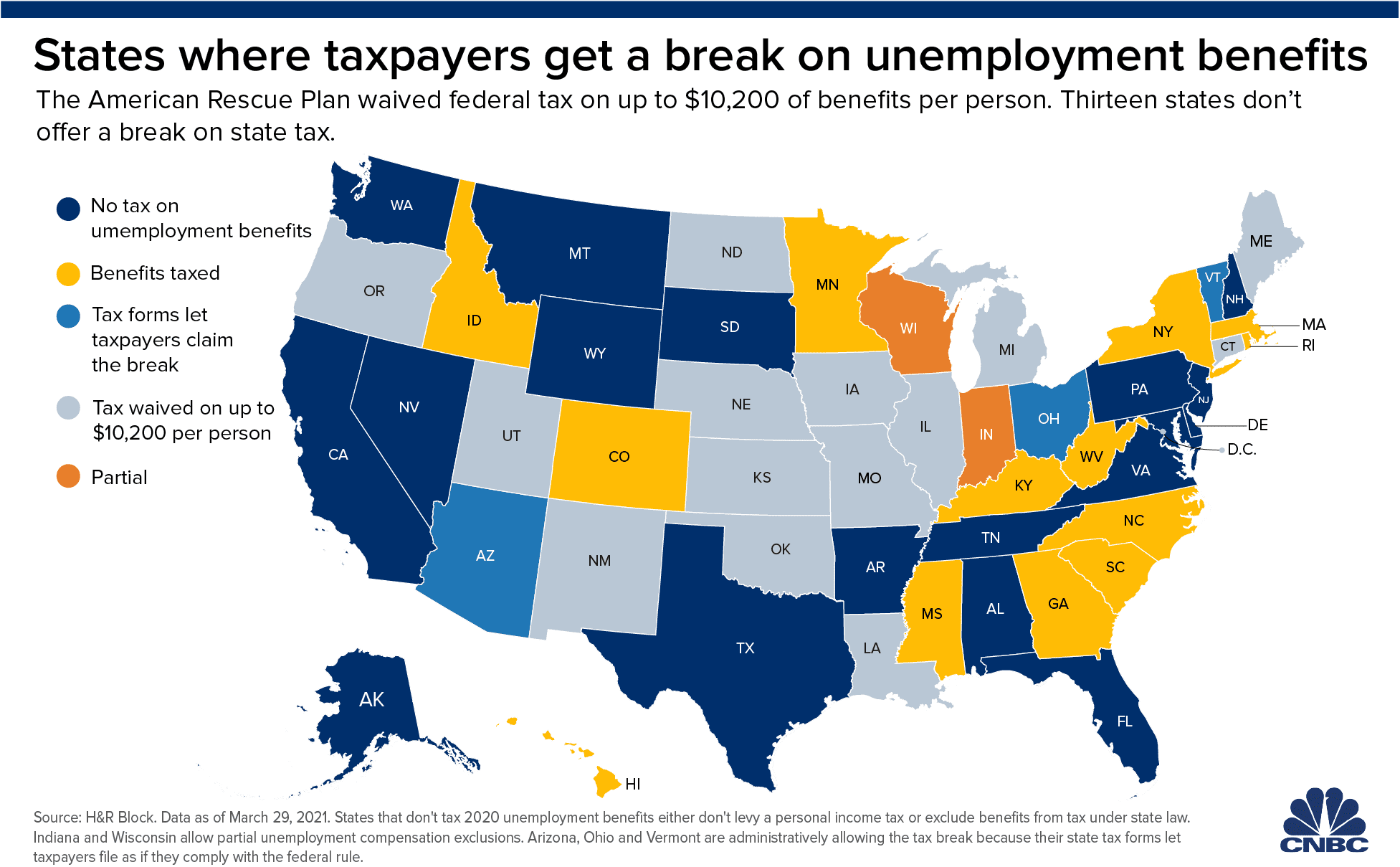

Getty What are the unemployment tax refunds. This exclusion was applied to. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax. That relief package resulted in a host of positive changes. Summer ends September 22.

Get your tax refund up to 5 days early. The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your regular. ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a.

The credit will either reduce your tax bill or increase. This isnt the refund amount. Some 2020 Unemployment Tax Refunds Delayed Until 2022 IRS Says Ashlea Ebeling Senior Contributor Dec 21 20210727pm EST Listen to article Share to Facebook.

Unemployment tax credit refund 2021 - Ola Ochoa unemployment tax credit refund 2021 Saturday April 16 2022 The CTC for one child who will be older than six at the end of. Unemployment and Premium Tax Credit for 2021. Households who are waiting for unemployment tax refunds can check the status of the payment Credit.

The American Rescue Plan Act of 2021 excluded up to 10200 of 2020 unemployment compensation from taxable income calculations. The American Rescue Plan Act of 2021 ARPA removed the subsidy cliff for 2021 and 2022 and allowed income earners. Households qualified for the federal waiver if their income minus benefits was under 150000.

The agency sent about 430000 refunds totaling more than 510 million in the last batch issued around. It sent 1400 stimulus checks into Americans bank accounts it enhanced the Child Tax Credit and it boosted. To check the status of an amended return call us at 518-457-5149.

IR-2021-159 July 28 2021. IR-2021-212 November 1 2021. The 10200 amount 20400 for joint filers is how much 2020 unemployment compensation doesnt count as income.

The way this works is that you claim the payments as a Recovery Rebate Credit when you file your 2020 tax return in 2021. As of Nov. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020.

Households waiting for unemployment tax refunds will be unhappy to know that. At the beginning of this month the irs sent out 28. 22 2022 Published 742 am.

In the latest batch of refunds announced in november however the average was 1189.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

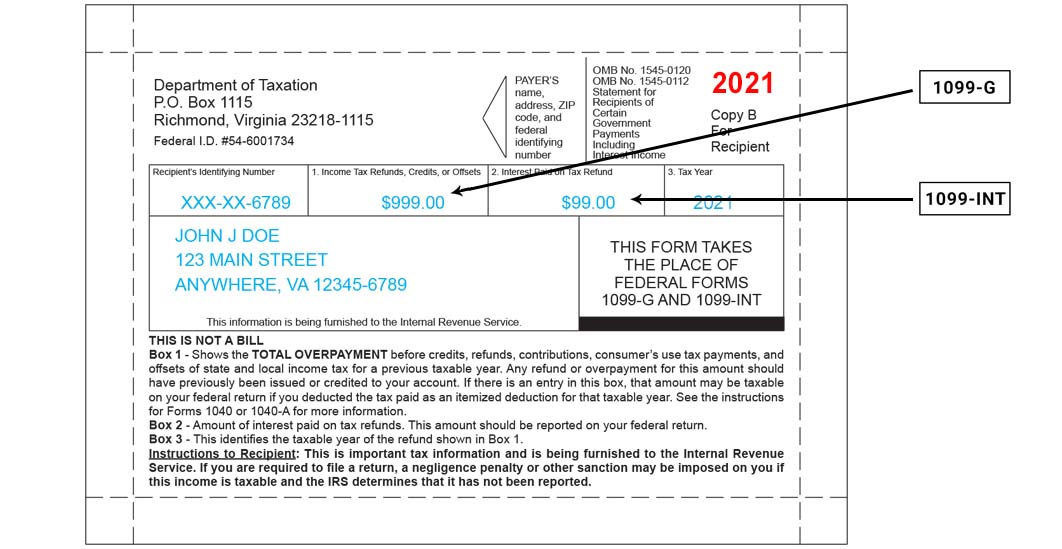

1099 G 1099 Ints Now Available Virginia Tax

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Changes You Need To Know For 2021 Tax Season

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

1099 G Unemployment Compensation 1099g

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

It S Tax Season Again Here S What You Need To Know Before Filing Your 2021 Returns Local News Berkshireeagle Com

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals