coweta county property tax rate

The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. Taxing authorities include Coweta county governments and numerous special districts eg.

Coweta County Ga Hallock Law Llc Property Tax Appeals

The 2018 United States Supreme Court decision in South Dakota v.

. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Coweta County Tax Appraisers office. The Coweta County sales tax rate is 3. As Ex-Officio Sheriff he may appoint Ex-Officio Deputy Sheriffs to act on his behalf in tax sale matters.

The 2020 millage rate of 3643 was set by Council in August. The Tax Commissioner of Coweta County also serves as Ex-Officio Sheriff of Coweta County. The sum of levies imposed by all related public entities.

Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. The Coweta County Sales Tax is collected by the merchant on all qualifying sales made within Coweta County. Such As Deeds Liens Property Tax More.

Please use the link below to plan your visit. Find All The Record Information You Need Here. Those entities include your city Coweta County districts and special purpose units that make up that total tax rate.

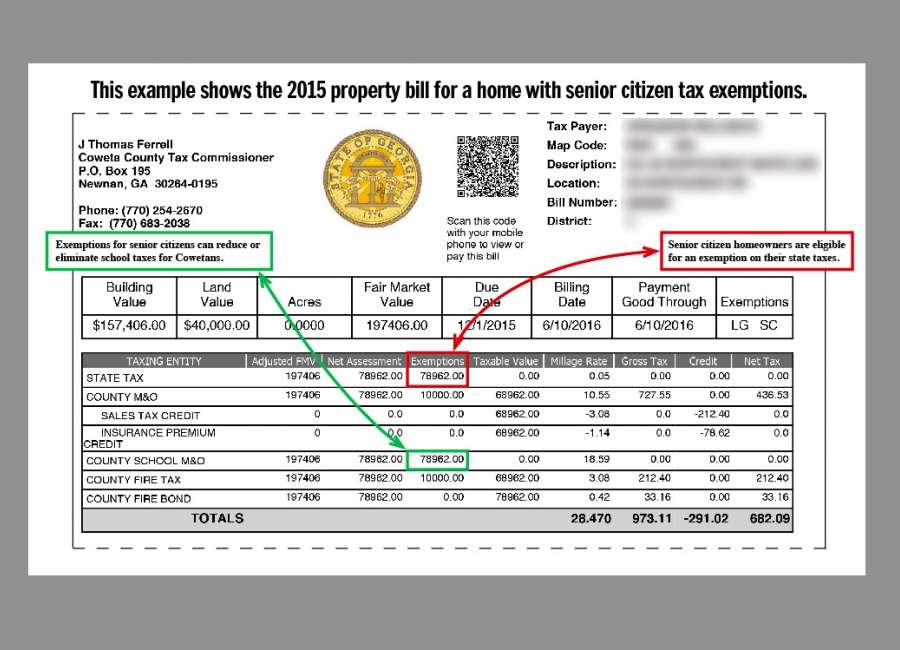

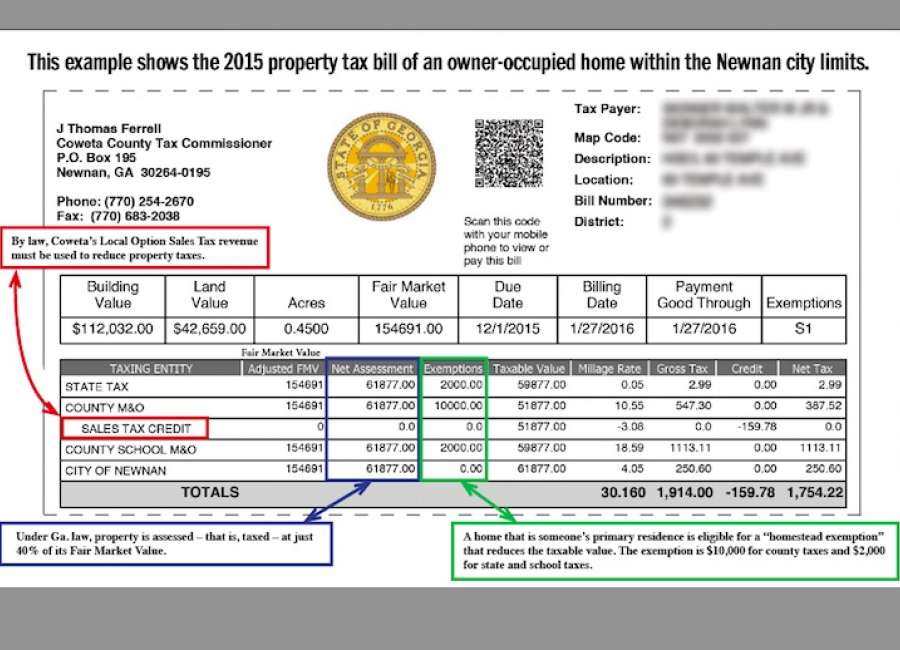

Georgia has a 4 sales tax and Coweta County collects an additional 3 so the minimum sales tax rate in Coweta County is 7 not including any city or special district taxes. Payments may be made to the county tax collector or treasurer instead of the assessor. In Coweta Countythe Tax Commissioner has transferred the responsibility for accepting homestead applications to the Tax Assessors office.

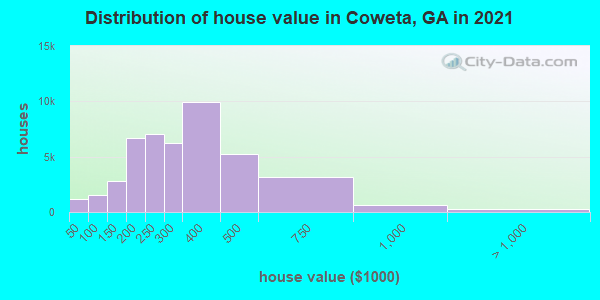

You will be redirected to the destination page below in 3. You will be redirected to the destination page below in 3 seconds. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median effective property tax rate of 081 of property value.

Any qualifying disabled veteran may be granted an exemption from paying property taxes for state. Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263. What is the property tax rate in Georgia County Coweta.

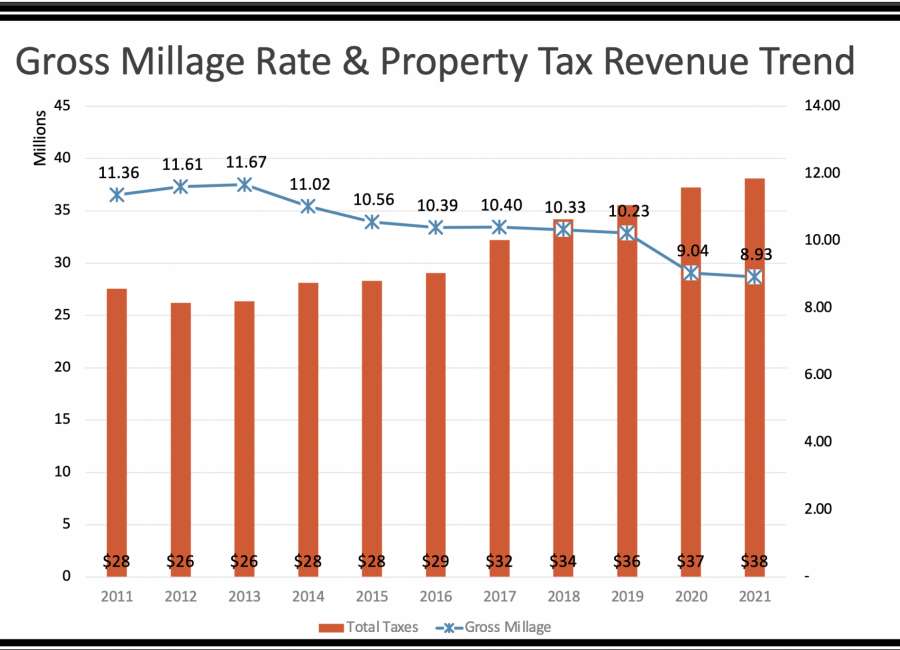

The Coweta County Georgia sales tax is 700 consisting of 400 Georgia state sales tax and 300 Coweta County local sales taxesThe local sales tax consists of a 300 county sales tax. Property or Ad Valorem Taxes Sales Taxes ELOST SPLOST FinesForfeitures LicensesPermits. The Newnan City Council sets the millage rate each year in the summer based on digest information provided by Coweta County.

That value is taken times a combined tax rate ie. Website Design by Granicus - Connecting People and Government. Use the Search and Pay Taxes link above to verify property tax payment received.

Funding sources for Coweta County include. Notice to Property Owners Occupants. The Coweta County GA Website is not responsible for the content of external sites.

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. The median property tax on a 17790000 house is 144099 in Coweta County. Coweta County collects a 3 local sales tax the maximum local sales tax.

Each Ex-Officio Deputy She riff has full power to advertise and bring property to sale for the purpose of collecting taxes due the state and county. They are a valuable tool for the real estate industry offering both. The Coweta County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan.

Search Valuable Data On A Property. Ad Unsure Of The Value Of Your Property. The minimum combined 2022 sales tax rate for Coweta County Georgia is 7.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The total sales tax rate in any given location can be broken down into state county city and special district rates. Thank you for visiting the Coweta County GA Website.

An appraiser from the county generally reassesses your propertys market value once every three years at least. They are maintained by various government offices in Coweta County Georgia State and at the Federal level. Start Your Homeowner Search Today.

Ad Get In-Depth Property Tax Data In Minutes. There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments. The responsibility to approve or deny the exemptions has always been that of the Board of Assessors.

Coweta County GA. Everyone visiting the County Administration Building is required to enter through the East Broad St entrance. Coweta County Tax Commissioner.

The median property tax on a 17790000 house is 147657 in Georgia. View Full Site. Coweta County collects on average 081 of a propertys assessed fair market value as.

The 2019 millage rate was 3989 mills per thousand dollars of assessed value which is slightly less than the 40 millage rate for 2018. Limited space is available in the lobby area. The Coweta County GA Website is not responsible for the content of external sites.

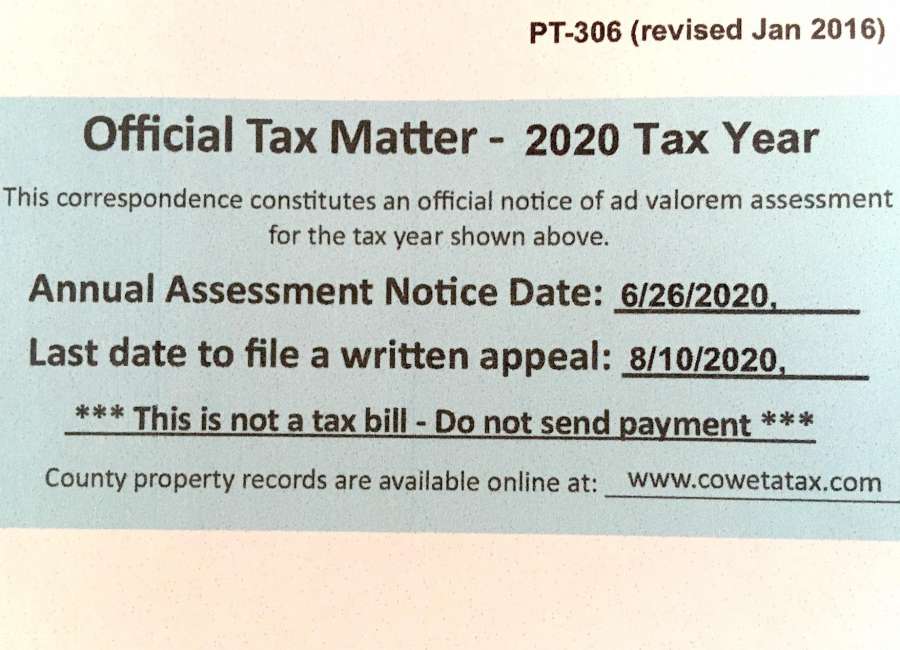

This table shows the total sales tax rates for all cities and towns in Coweta County. You are now exiting the Coweta County GA Website. In accordance with Georgia Law OCGA 48-5-2641 property owners and occupants are notified that appraisers from the Tax Assessors office routinely review all properties within the county.

They all are public governing bodies administered by elected or appointed officers. This is the total of state and county sales tax rates. The Georgia state sales tax rate is currently 4.

Thank you for visiting the Coweta County GA Website.

Transfer Station Coweta County Ga Website

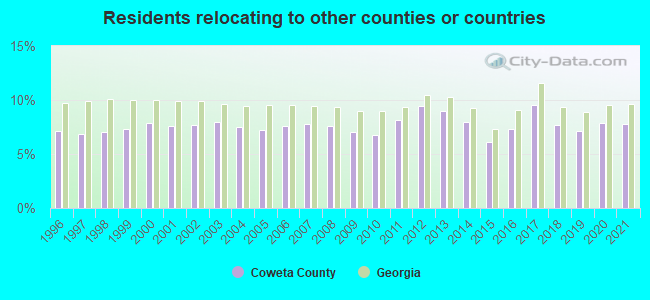

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

One For Coweta Sales Tax Increase Passes News Tulsaworld Com

County Sets Millage Rates The Newnan Times Herald

Property Values Skyrocket But Taxes Haven T Been Set The Newnan Times Herald

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

3 S 305th Ave Eeast Coweta Ok 74429 Realtor Com

Georgia Property Tax Calculator Smartasset

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Coweta School Board Approves 2021 22 Budget Winters Media

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

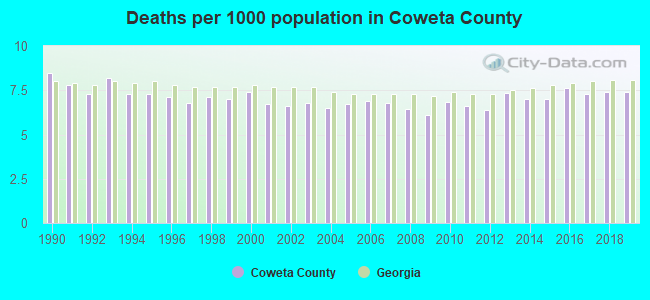

Coweta County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More